*Read TurboTax Business customer reviews at /small-business and learn what small business owners like and complain about.

#TURBOTAX FOR S CORP 2019 SOFTWARE#

Read both to better understand if TurboTax Business is the best tax software for your small business, S Corp, or LLC. That’s ok! I’ve found that you can usually learn more from negative reviews than positive ones. While most customers are happy with both the cost and experience, there are a number of bad reviews, too. If a TTS partnership or S-Corp wants to revoke a prior year Section 475 election, a revocation election statement is due by March 16, 2020.The product page on is the only place online where you can read honest reviews for TurboTax Business from verified customers. Section 475 income, net of TTS expenses, is eligible for the “qualified business income” (QBI) deduction subject to taxable income limitations. Section 475 turns 2020 capital gains and losses into ordinary gains and losses, thereby avoiding the capital loss limitation and wash sale loss adjustments (tax loss insurance). Traders, eligible for TTS, should consider attaching a 2020 Section 475 election statement to their 2019 tax return or extension due by March 16, 2020, for partnerships and S-Corps, or by April 15, 2020, for individuals. TTS partnerships face significant obstacles in achieving self-employment income.)Ģ020 Section 475 MTM elections for S-Corps and partnerships (See Late Election Relief.) (Sole proprietor traders do not have self-employment income, which means they cannot have self-employed health insurance and retirement plan deductions. If you overlooked filing a 2019 S-Corp election by Maand intended to elect S-Corp tax treatment as of that date, you may qualify for IRS relief. Most states accept the federal S-Corp election, but a few states do not they require a separate S-Corp election filing by March 16. They should consider a 2020 S-Corp election on Form 2553 for an existing trading entity, due by March 16, 2020, or form a new company and file an S-Corp election within 75 days of inception. Traders qualifying for trader tax status (TTS) and interested in employee benefit plan deductions, including health insurance and retirement plan deductions, probably need an S-Corp. The penalty is $205 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were partners in the partnership during any part of the partnership’s tax year for which the return is due. A penalty is assessed against the partnership if it is required to file a partnership return and it (a) fails to file the return by the due date, including extensions, or (b) files a return that fails to show all the information required, unless such failure is due to reasonable cause. See partnership 2019 Form 1065 instructions, “Penalties” on page 6: For returns on which no tax is due, the penalty is $205 for each month or part of a month (up to 12 months) the return is late or doesn’t include the required information, multiplied by the total number of persons who were shareholders in the corporation during any part of the corporation’s tax year for which the return is due.

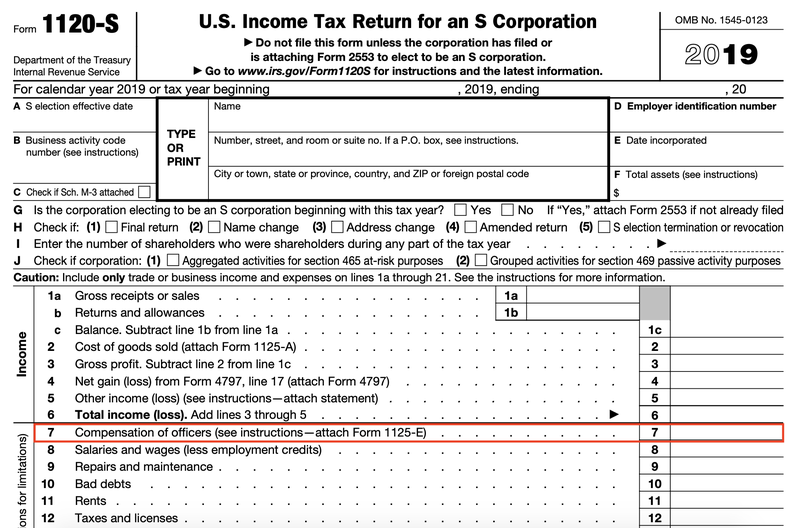

A penalty may be assessed if the return is filed after the due date (including extensions) or the return doesn’t show all the information required, unless each failure is due to reasonable cause. See S-Corp 2019 Form 1120-S instructions, “Interest and Penalties” on page 4: Some states have S-Corp franchise taxes, excise taxes, or minimum taxes, and payments are usually due with the extensions by March 16. LLCs filing as a partnership may have minimum taxes or annual reports due to the extension by March 16. States assess penalties and interest, often based on payments due. Some states require a state extension filing, whereas others accept the federal extension. 2019 S-Corp and partnership extensions give six additional months to file a federal tax return, by September 15, 2020.

For S-Corps and partnerships, use Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns).

0 kommentar(er)

0 kommentar(er)